In order to select good stocks, three steps should be taken: the first step is to select good sectors; The second step is to select high-quality stocks of the sector; The third step is to select stocks with good shape on the K line chart. By answering the following three questions, we can basically master the skills of stock selection.

How to select a good plate?

A good stock sector needs to have the following characteristics:

- The plate trend must be upward tilt, and the weekly and monthly trend can be referred to.

The upward trend means that it is in a strong stage. Even if the entry time is wrong, it will be pulled up soon when it encounters a callback. This is the power of the trend. If you have a bottom hunting mentality, you may be trapped if you choose those plates that have fallen for a long time, and even lower after the low point. Even if it can rise in the future, it will be a long time later, and it may not rise again.

- The plate must conform to the general trend of economy. For example, in the period of inflation, it is necessary to choose cyclical stocks, in the period of energy structure transformation, it is necessary to choose new energy, and in the period of monetary tightening, it is necessary to choose banking stocks.

- Very small number of people. It is better not to choose the plate that cannot form a hot spot. For example, publications, advertising packaging, etc., the funds that these plates can hold are very limited, and it is very difficult to have a big continuous hot spot.

How to select high-quality stocks in a good sector?

- Stable growth performance. For stocks without performance support, how high the stock price rises is a castle in the air. It must have its own main business and a certain market share in its own field.

- The management did not commit fraud. The stocks that cheat in the financial statements must not be touched. With the improvement of the securities market management, the stocks that cheat will be gradually abandoned by the market, which may trigger delisting in serious cases.

- The market value should not be too small. Unless it is at the end of a bear market and there are stocks with single digit prices everywhere, do not choose stocks with too small market value. The stocks with too small market value may have Laozhuang. Some Laozhuang play the rally once a year or two, and other times they shake on the ground, making it difficult for individual investors to keep up with the pace.

How to choose a good stock?

In line with one principle: rise without selection, and turn down without selection.

Starting without selection means that the stock has been on the decline channel for a long time, and suddenly the stock price rises sharply one day or several days. This trend is generally unsustainable, mostly because some funds are saving themselves, and the stock will return to the downward trend after they escape. Stocks that do not experience shocks after a long decline are difficult to turn from bears to bulls.

Don't try to copy the bottom. Even if the stock price suddenly drops from a high point and looks very attractive, you can't go greedy to win a rebound at this time. If you don't pay attention, you may be caught with a flying knife.

Common good forms:

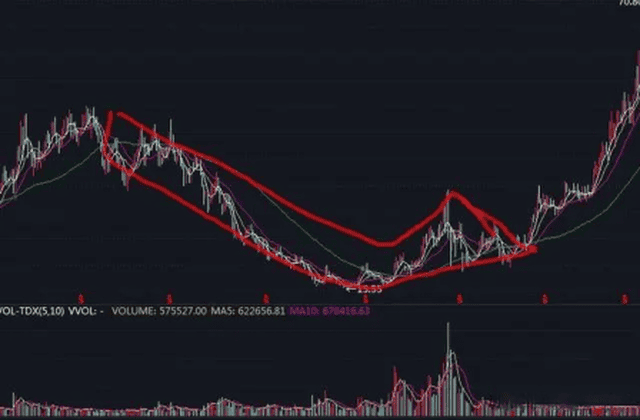

- Kick the big black horse. The weekly K line has gone out of the downward trend, and there has been a shock for a long time. The moving average gradually intersects with the K line. With the increase of trading volume, the bottom is raised, which looks like a kick out.

- The dragon goes out to sea. The weekly chart fluctuates at a low level for a long time to build a solid bottom, and the rising trading volume enlarges and the falling trading volume shrinks during each shock. At the end of the shock, the bottom gradually rises until it crosses the bottom platform.