Buy financial products, first of all, to avoid the loss of principal, and then to find ways to get higher returns, most people are so planning, but the real implementation of the time began to be difficult, after all, financial products are not in our personal hands, to buy financial products to get a good return, it is necessary to make some effort.

How to buy 2023 financial products with high returns?

choose suitable for their own financial products, financial products from a wide range of aspects are including many types, and funds, stock market, precious metals investment risk is too large, obviously not suitable for ordinary people with little money to invest, no investment experience is also not able to bear the greater risk, it is recommended to choose treasury bonds, currency funds, bank deposits and so on.

To choose the investment channels that meet their actual situation, most people buy financial products through banks, then buy to ensure that you buy the financial products that are suitable for their risk-taking ability, remember to do risk assessment, according to their actual situation to do the selection questions.

choose good financial products, although there is no absolute good or bad financial products, but those historical performance, the manager is experienced, the financial products belong to a company with high visibility strength, etc., can help you earn money is a higher probability.

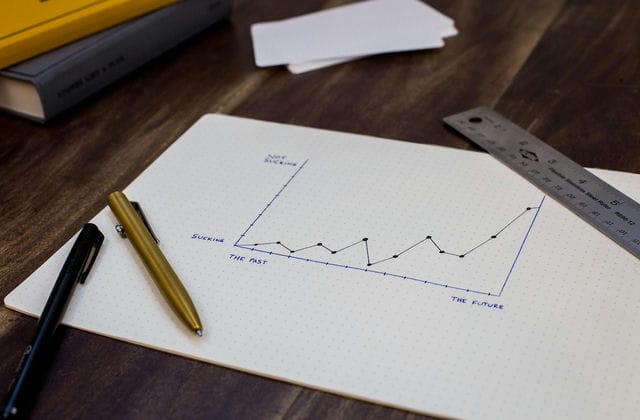

adhere to the end, do not easily choose, but once you choose to adhere to the end, most of the financial products to adhere to the earnings will only be reflected after, such as about 2 years, most of the funds are able to earn money.

Combine demand finance with long-term investment, you can combine demand finance with long-term investment, because this ensures both the circulation of funds and financial returns.

choose to deposit a longer term, to 3 years or 5 years, the longer the term deposit interest rates will be higher, but it should be noted that the longer the term of the product, the less flexible, can not be taken out at any time in the middle.

The profitability of the financial product itself, the profitability of the financial product is not 0 rate may not be able to run the other financial products; on the contrary, a financial product is very strong ability to make money, although it charges a management fee of up to 1%, but it ultimately returns to the investor's profit may also be far more than 0 rate financial products.

If you intend to buy a financial product, first you have to take out a portion of your own free money and be prepared to lose money. When choosing a financial product, the profit and loss analysis data is for reference only, please refer to the actual return after the product expires or is redeemed.